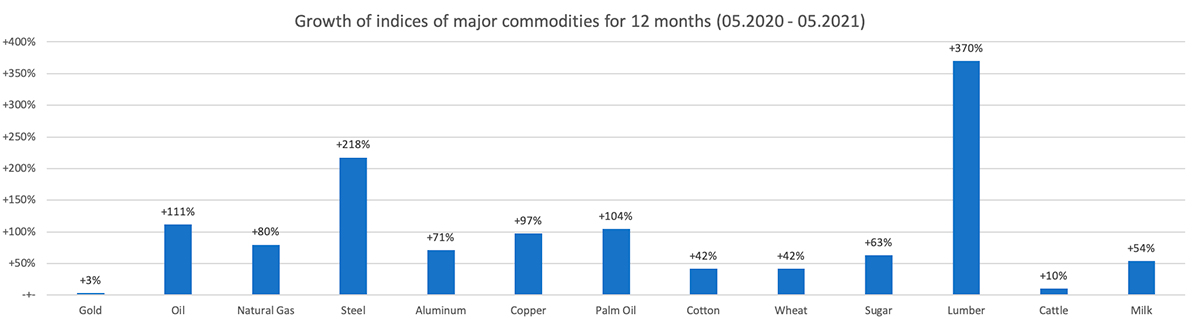

Today we see a significant change in the Markets by major commodity:

This growth is affecting almost all product categories. In addition, since the fall of 2020, the deficit of containers on sea lines began to increase, which in 2021 led to an increase in the cost of sea freight by 300% -400%. At the same time, the OT (On Time) indicator fell sharply from 70-80% to 40%, which served as an increase in uncertainty at the level of supply chains and the need to increase inventories to ensure the stable operation of enterprises. Considering that 60% of all global goods are transported in containers, this has become another powerful factor in the growth of prices in general, and especially for imported goods.

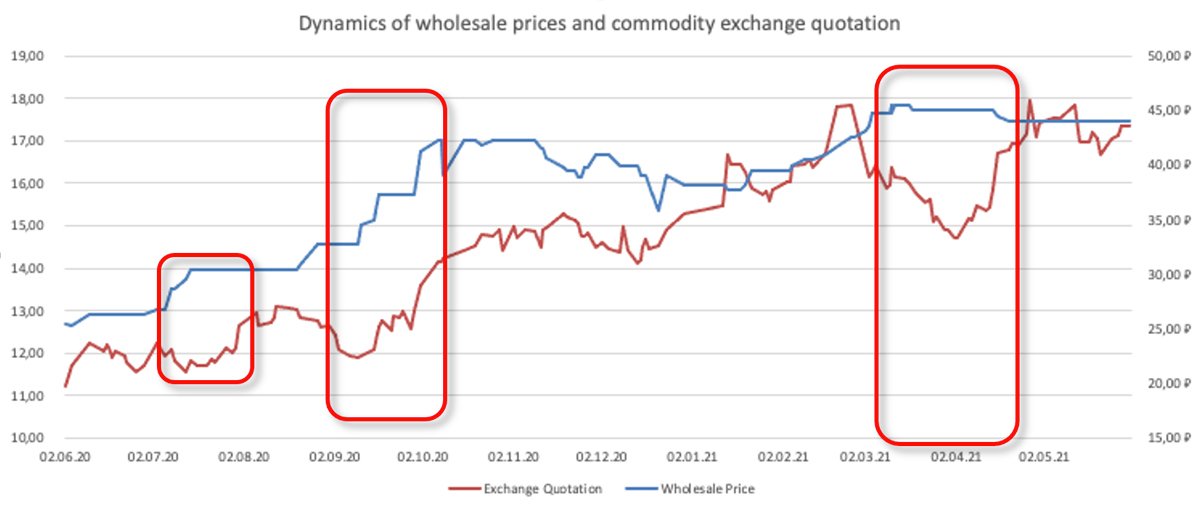

The Global Market has a direct impact on wholesale prices within Russia and in other countries, and their dynamics are largely the same. There are categories of goods (for example, non-ferrous metals) that are sold (and accept as recyclable) with direct reference to the prices of the London Metal Exchange (LME). In the agricultural segment, producers are guided by export prices, and domestic wholesale prices are simultaneously going up. For example, back in 2020, Russia showed sugar export records, which, against the backdrop of a low sugar beet harvest in 2020, led to a deficit in the domestic market and an increase in imports, including the introduction of duty-free import quotas. Against this background, domestic wholesale prices remain sensitive to currency fluctuations.

There is an opinion that the localization of Procurement can reduce costs. This is not always the case, for example, the local Russian palm oil market is represented by a commercial oligopoly of several players - oil and fat factories that position themselves as producers, but in fact are simple importers who buy ready-made palm oil fractions in bulk in Malaysia / Indonesia, and simply packaged in Russia. And this is logical, since the palm tree does not grow on an industrial scale in our country. Therefore, Procurement should always look broader at all possibilities, and in the example of palm oil, going from the local market to the competitive global one immediately allows you to get a reduction in total costs by more than 15% and understandable pricing for the long term (and this is taking into account all costs, including customs clearance and logistics).

For a number of companies, the unstable situation turned out to be beneficial. So, for example, importers or wholesalers disproportionately raised prices ahead of the growing Market, focusing on futures and forecasts, but in a falling Market or fluctuations they were in no hurry to reduce prices.

Practical example:

But for manufacturing companies (purchasing raw materials), the impact was rather negative. These companies are often contractually bound by sales prices. For example:

- confectionery manufacturers experienced an increase in COGS of up to 40% and lost margins due to price fixing with retail companies;

- construction developers are limited by the terms of equity participation agreements, and the rise in prices for basic building materials also negatively affects the profitability of projects.

If a year ago Procurement could fix the price for 6 months, 1 or even 2 years, today this fixation is impossible or is very expensive. Today, in the context of volatile Markets, Procurement is forced to revise its strategies, and this article will focus on the main ones:

- 1. Spot price

- 2. Formula

- 3. Hedging

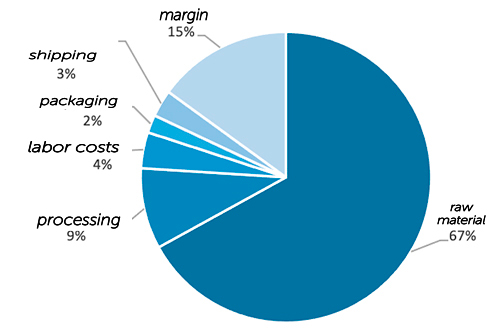

Price structure

Before describing these strategies, it is important to clarify that Procurement should not treat price as a monolith, any price consists of components, and understanding the supplier's pricing mechanism allows you to define a strategy, prepare in detail for price negotiations and identify potential savings. The supplier's unit price can be made up of the following components:

- 1. Raw materials and supplies;

- 2. Completing products, semi-finished products and production services purchased from other enterprises;

- 3. Fuel and energy of all kinds for technological purposes;

- 4. Recyclable waste (revenue item);

- 5. Losses from marriage, natural attrition and unknown losses;

- 6. Labor Cost of production workers;

- 7. Costs for the maintenance and operation of equipment;

- 8. General production (shop) costs;

- 9. General business (general or general plant) costs;

- 10. Non-production (commercial) costs of selling products (eg, costs of containers and packaging; costs of transportation of products);

- 11. Margin.

Some of the components are mostly simple, i.e., homogeneous in their economic content (for example, raw materials and supplies). Other price components are complex and combine several economic elements. So, for example, the composition of general production and general expenses includes labor costs, depreciation of fixed assets, and the cost of fuel, energy (except for those spent on technological needs), and auxiliary materials, although each of these types of costs represents different economic elements.

For strategic partnership forms, it is normal practice to work with an "open book", the supplier can disclose its price structure and work together with the Buyer to optimize its individual components, including the use of joint best practices (for example, in logistics or packaging).

However, suppliers are not always ready to disclose the price structure; in this case, you can apply the "white sheet" method and independently calculate individual components using data from open sources:

- stock exchange commodity indices;

- data from state and independent industry statistics;

- price monitoring data;

- data of annual and quarterly reports (for public companies);

- data of open accounting reports,

as well as economic models of similar enterprises and information from other suppliers or suppliers of suppliers.

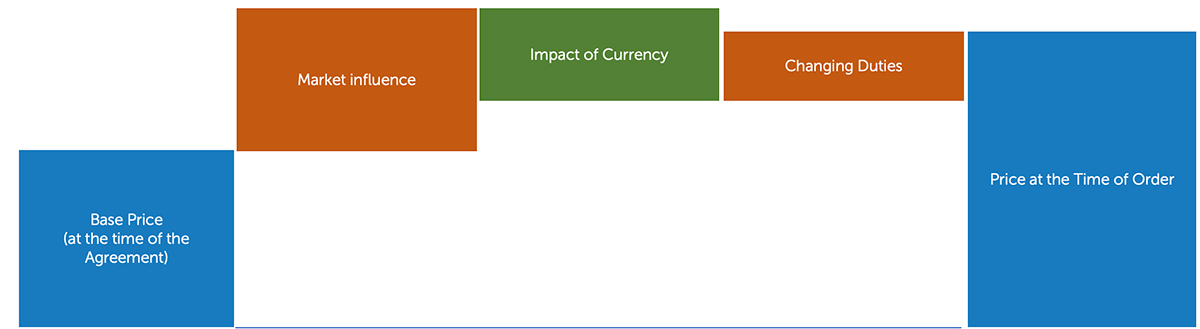

The price structure can be as follows:

If the price component, influenced by market factors, has a low share in the price structure, then the factors influencing its change can be neglected to simplify the economic model of interaction between the supplier and the buyer.

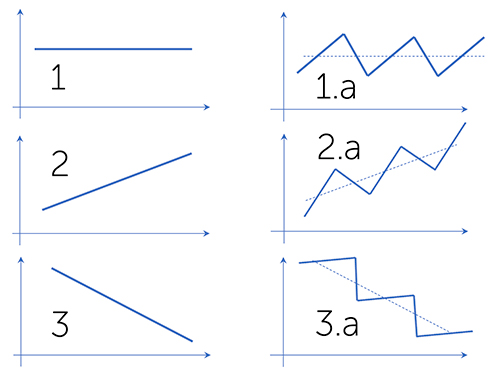

Market Behavior Models

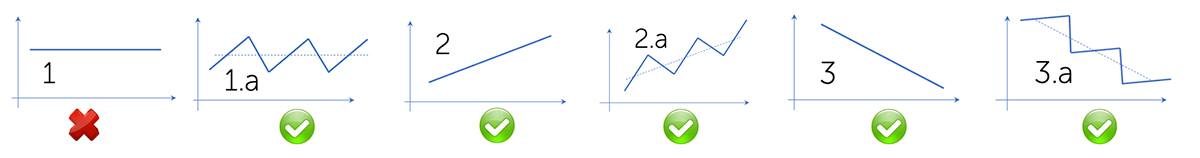

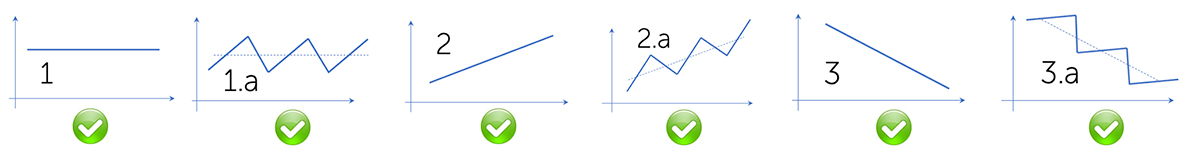

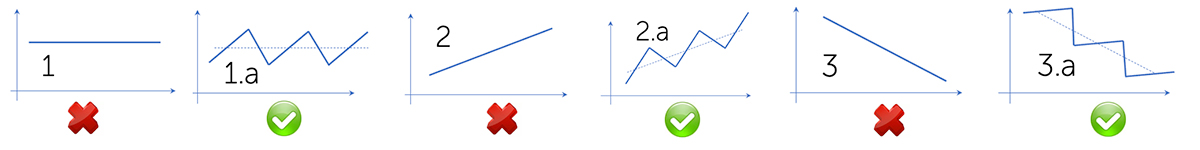

There are six main patterns of Market behavior:

Model 1 - the market is stable (sideways trend or flat);

Model 2 - the market has a steady uptrend;

Model 3 - the market has a steady downward trend;

In models 1, 2 and 3, short-term or insignificant fluctuations within the general trend are possible, which do not significantly affect the price / price component outside the trend.

In models 1.а, 2.а and 3.а, significant fluctuations are superimposed on the general trend, which can have a temporal amplitude from a week to a month.

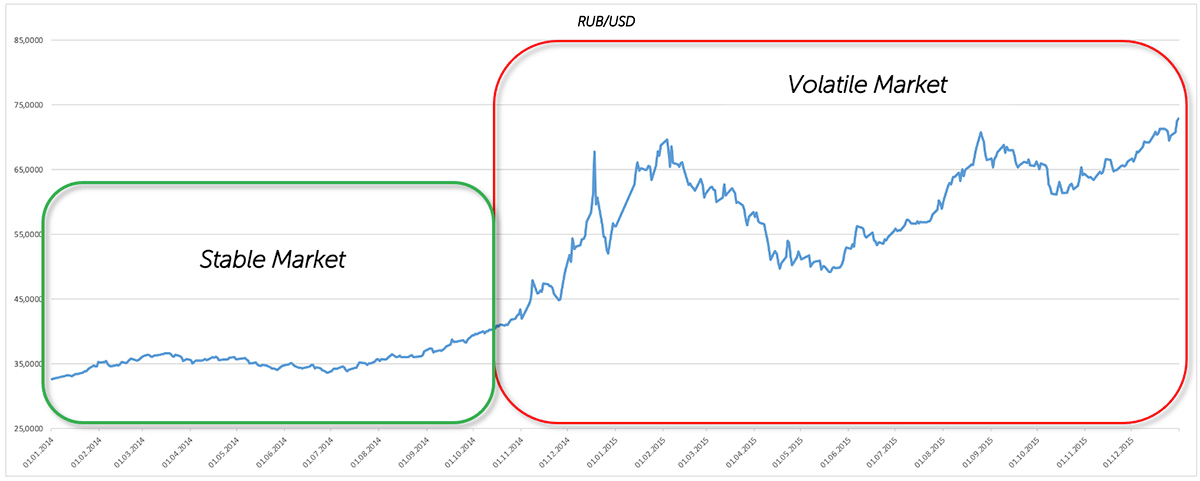

Understanding of the Market model is necessary for choosing a procurement strategy, as well as forecasting changes in strategy when changing market dynamics. For example, a sideways trend can be replaced by sharp fluctuations and growth, as was the case with the Russian currency at the end of 2014:

So, let's move on to the strategies themselves:

1. Spot price

The spot price strategy is the simplest, and sometimes the only one available to the Buyer. Price fixing can be for a month, for a week, or for each order. The buyer has to correlate the current purchse conditions with the spot conditions (at the moment).

But despite the simplicity, when working with this procurement strategy, there are also rules:

- the condition for the formation of a pool of suppliers and the potential volume are known at the tender stage;

- suppliers that form the pool give the best conditions "in the moment" and accept mandatory conditions (for example, payment terms);

- framework contract are concluded with all the winners (no volume);

- each lot is put up for auction, possibly through a corporate electronic trading platform (ETP);

- all participants receive honest feedback on the results of the "bidding".

This approach is applicable to any changing markets.

Pros and cons of this strategy:

«+»

- Allows you to be in Market trend and promptly initiate changes.

«-»

- High labor intensity: the buyer is forced to conduct a “bidding” at each price change (Supply format).

- The levers of Strategic Procurement are lost. The buyer cannot operate with forecasts of the annual volume, discuss the terms of rebate, etc.

- “Bidding” is not comparable to a well-developed strategic tender, the optimal price level is not achieved and it is impossible to develop deep relationships with the supplier.

- Given this strategy, the Company finds it difficult to forecast COGS / spend.

2. Formula

The formula strategy is to distribute the Market risks equitably between the supplier and the buyer. Application of this approach in a stable market is advisable only in the case of a strong dependence of the price on direct economic factors (DEF).

The price formula allows you to go from the base price (the price at the time of the conclusion of the contract) to the price at the time of the Order, taking into account direct economic factors:

- changes in commodity indices;

- currency fluctuations;

- changes in duties, excise taxes and fees.

In some cases, there may be several factors of the commodity market and several factors of influence of currencies for different components of the price.

The key criterion for the success of applying the formula in pricing is the correct determination of the share of the influence of each component of the price. Otherwise, deviations are possible both in favor of the seller and in favor of the buyer when the market rises or falls.

Pros and cons of this strategy:

«+»

- The formula sets the rule for price changes exactly in the market trend.

- Allows you to predict the price based on forecasts and futures quotes.

- The advantages of strategic partnership remain and tender iterations with the Supplier are reduced.

«-»

- Not all suppliers are willing to negotiate formula pricing.

- There is a risk of making a mistake with the formula parameter.

- The COGS / spend forecast is still not accurate.

3. Hedging

Hedging is an action to reduce risk. Usually, risk reduction leads to a decrease in profitability, in the context of Procurement - to less savings.

The buyer hedges his risks in the growing markets, the supplier - in the falling ones. For regular purchases in market model 2, hedging is not justified, since purchases still end up with an increase in value. But for one-off purchases, hedging is justified for models 2 and 2.a. In market model 3.a, this may be partially justified in the presence of high fluctuations.

In terms of material purchasing, there are two hedging strategies:

- purchase of futures or direct fixation to the price of futures contracts;

- stock creation (possibly on the supplier's side).

At the same time, there is a high probability that the futures price will be higher than spot market. And creating stock is always associated with additional costs.

Pros and cons of this strategy:

«+»

- Accurate COGS / spend forecasting.

«-»

- As a rule, the loss of part of the procurement savings.

- It is not always possible to work with futures.

- There is not always free cash to create stocks.

Conclusions

To successfully implement a procurement strategy in volatile markets, it is necessary:

|

Know the price structure |

|

Know market drivers |

|

Know the dynamics of the market and compare with the dynamics of prices |

|

Use analytical benchmarking tools |

|

Explore forecasts |

|

Apply different procurement strategies depending on the context |