After publication of the article «Procurement Savings vs Budget», I planned to consider in detail the impact of Inflation on the indicators of procurement savings, however, the topic of the Budget caused heated discussions, and I decided to continue it.

So, in the last article, we identified two main reasons why it is incorrect to use Budget indicators in measuring procurement savings:

- Firstly, the budget is inaccurate, it is often overestimated and includes inflationary expectations;

- Secondly, procurement savings should already be included in the Budget.

Yes, many companies still use the model of calculating savings “from the Budget” and understanding all the imperfections of this method, put forward the argument in its defense: “we are constantly working to improve the accuracy of the forecast and budget!”.

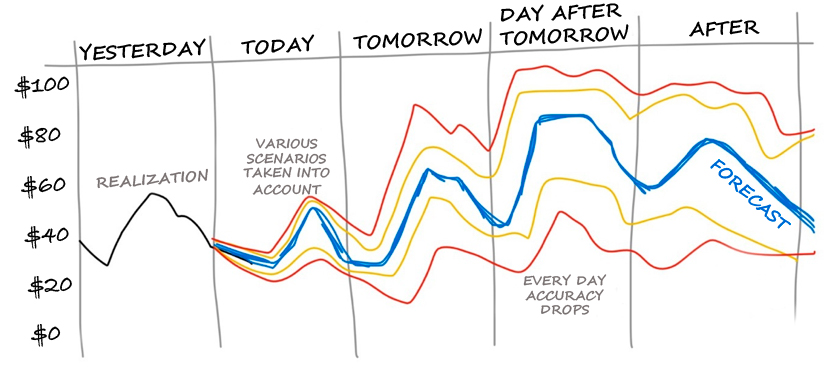

Forecast accuracy

There are several main scenarios of financial reporting:

- Target is to be built for 1 year from the middle of Y-1 and specified at the beginning of the “target” year Y. It serves as the basis for the construction of a Direct Procurement Budget (COGS) and OPEX;

- Plan - formed for 3-5 years, reviewed annually, serves as the basis for the investment budget (CAPEX);

- Forecast - during the reporting year there are time points when a forecast is made until the end of the year, deviations from targets are considered and a corrective action plan is adopted. This may affect budget changes. For example, if commercial indicators are not fulfilled due to the COVID-19 virus, it is logical that budget expenditures should also be revised downward;

- Updated forecast - an operational forecast until the end of the year, can be done on a weekly basis;

- And the last scenario is Realization.

Of all these scenarios, only the last one is accurate. All other forecasting methods have an error, while:

- the longer the time period, the lower the accuracy of the forecast;

- and the higher the level of granularity, the less accurate the forecast. For example, at the level of the enterprise as a whole, forecast accuracy is usually higher, and it decreases at the level of single directions and completely falls at the level of single items. The reason is simple: there are no resources to make a qualitative forecast on the level of all subcategories, suppliers and items.

Therefore, the figures of targets and forecasts should not be taken into account when calculating realized savings. Only realized figures of the current year and realized figures of a comparable period of last year can be matched.

What can a comparison of exact realized figures with inaccurate forecast vision numbers mean? Probably show the quality of forecasting, but certainly not the savings.

Different patterns of calculating savings

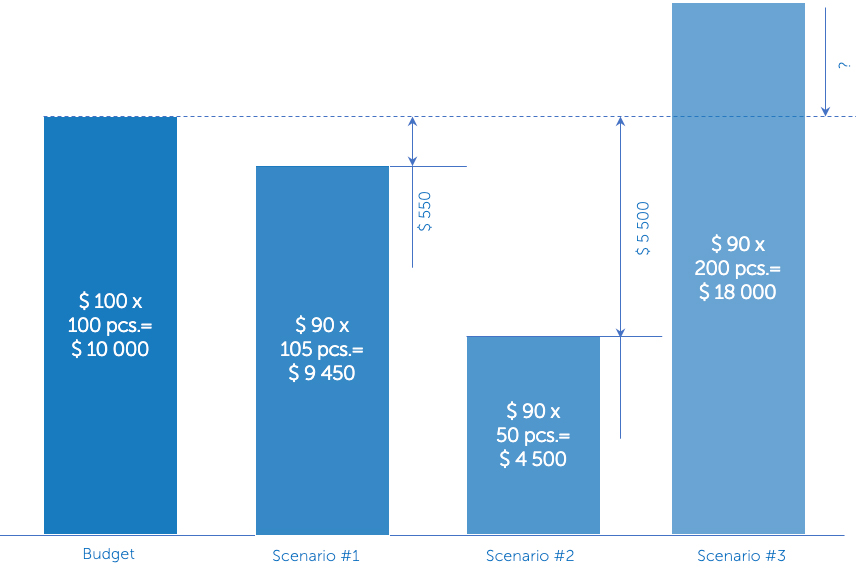

The principles of calculating savings “from the budget” and from the historical baseline are diametrically opposed. For example, you purchase certain components N for production, the budget is formed according to the production plan - 100 pcs. per month and prices - $100 (like last year), i.e. the budget is $10 000 a month. The buyer holds a bidding and reduces the price by $10, but at the same time for the production requires the purchase of an additional 5 units of components. Thus, 105 pieces were spent on the purchase. X $90 = $9 450. What is the procurement savings?

- according to “budget savings”: $9 450 (purchase costs) - $10 000 (budget) = - $550

- according to the calculation from the historical price baseline: ($90 - $100) * 105 pcs. = -$1 050

But what if the production is not 100 pieces, but 50? For example, a large client will refuse an order. Then:

- "from the budget": $4 500 (purchase costs) - $10 000 (budget) = - $5 500. Here is wonder what moral right the buyer will have to declare such savings?

- from the historical baseline: ($90 - $100) * 50 pcs. = - $500.

And what will happen to the budget savings if an unscheduled order for 100 units is received for production ...

In fact, in this example, procurement does NOT control consumption and purchases exactly the quantity that production requires. Whether it fits the budget or not, procurement should be all the same. But purchases should definitely understand how the price changes relative to the past comparable period. The difference between the budget and actual procurement costs reflects the quality of budget planning, but not the quality of procurement.

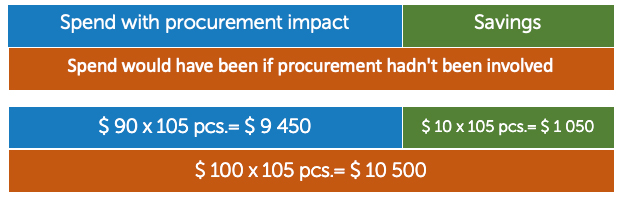

How much would have been spent on the purchase in the first scenario (105 pcs.), If the buyer had not made a tender: 105 pcs. X $100 = $10 500 and spent $9 450. In fact, $1 050 and there is realized savings.

That is, with the growth of consumption, the realized savings grows, and the "budget savings" goes down.

Budget exceeded

Yes, as a rule, the budget is overstated. There are many reasons for this, but the main reason is that it’s more comfortable to work because there are usually fewer questions if you are “on the budget”. But happens when the budget is “underpriced”, more often it happens with investment projects:

- did not take into account the mass of factors that unexpectedly arise in the implementation process;

- “missed” with the specification, and when the clarified technical specifications appear, the cost is different;

- or the supplier did not understand the request, because at the stage of budget formation, as a rule, there is no exact technical requirements and specification. By the way, this is very cool, if it appears at all.

So, here is laid 1 million USD on the project, and during the implementation its “went beyond the budget.” What to do with savings? A contingency situation ... And here fantasies begin: from the "average market" (but who can tell me what the "average market" is?), From the additional budget, from the average of bids ... But this all has nothing to do with procurement savings.

It does not matter whether the budget is exceeded or not, the procurement savings are calculated according to other rules that can determine the net impact of the buyer to the savings.

So, here we have the disappointing conclusions:

- “budget savings” are inaccurate by definition;

- the logic of its calculation does not correspond to the logic of business processes;

- a budget should already be formed taking into account identified procurement savings;

- the declared "budget savings" does not inspire confidence and does not motivate the procurement team.

The only real reason why companies use budget savings is simply and very “in the spirit” of bookkeeping, which loves to set for everyone their accounting standards. So, let’s stop calling the indicator “deviation from the budget” an indicator of savings, and let’s be honest with the company and ourselves: either we choose professional methodology for calculating the procurement savings, or we completely refuse to measure it!